Saltus Triumphus

At Aurelius, we are committed to ensuring the most effective process for the distribution of our tokens. Our recent initiative, which involved the allocation of Salt points and their subsequent conversion to AU tokens, has provided us with valuable insights and opportunities for improvement. Here, we present a detailed overview of this process and share some key takeaways and insights.

Total Salt Distributed: 542,271,707

Total Users: 1008 (888 max)

Total Average per user: 537,967

Total Mean per user: 281,823

Total Medium per user: 187,783

Total AU to be airdroppped (as oAU): 10,000,000

The Distribution Process

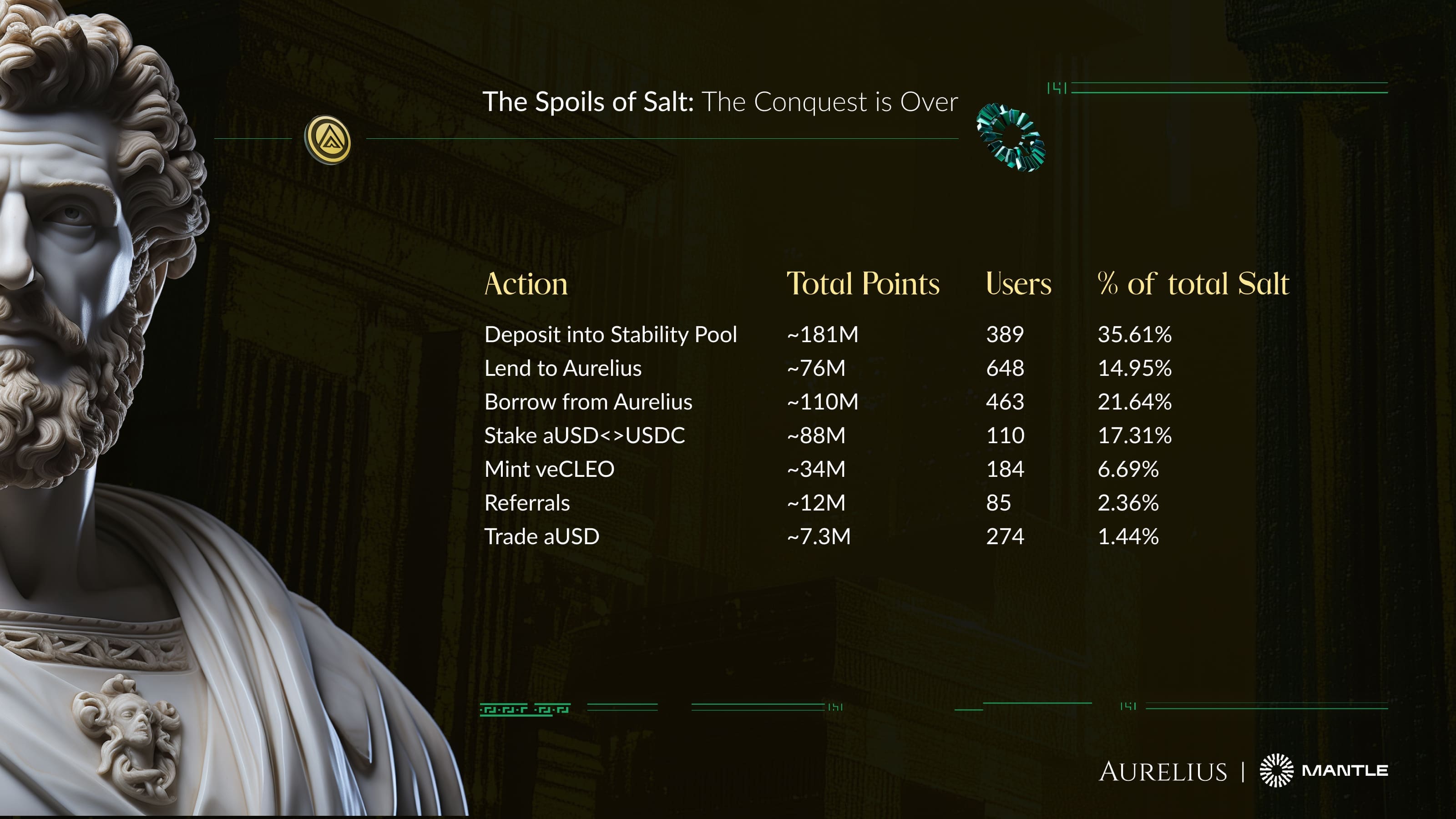

The allocation of Salt points was based on several key actions:

- Deposits into the Stability Pool

- Lending and borrowing from Aurelius

- Staking aUSD<>USDC

- Minting veCLEO

- Making referrals

- Trading aUSD

These activities played significant roles in the overall distribution scheme, ensuring a balanced approach to how points were awarded. In total, approximately 542 million Salt points were distributed among the 1008 users.

Salt → oAU

The conversion rate from Salt to oAU will be simple: about 54.23 Salt per oAU. This easy-to-follow rate ensures clear communication and an understandable process for everyone.

After reviewing the distribution, any changes from a simple distribution had negative effects and did not impact the lower distributions enough to justify it. For context, position 788 → 888 Salt distributions range from 1,780 down to the lowest of 512.

Key Insights

Several important insights emerged from the distribution:- Trading for Salt significantly strengthened the market price of aUSD to $1. This action also provided substantial rewards to liquidity providers and veCLEO voters. Ensuring the availability of this trading mechanism from day one is crucial for system maturity and user confidence in the CDP.

- Activities related to the Stability Pool and market activities (lending and borrowing) received nearly equal allocations Should a user want to borrow the supplied MNT collateral they will need to create a new over-collateralized loan. As an example, a user borrowing MNT at 50% LTV maintaining a 1.5 Health Ratio would depost $1 of collateral to borrow $0.50 MNT

- Trading aUSD accounted for only 1.44% of the total Salt distributed, much lower than user expectations.

- Similarly, referrals did not perform as well as anticipated, partly due to inconsistencies with the provider’s evolving product offerings.

- Approximately 11.9% of participants will not receive an allocation, as their contributions were not deemed significant enough. This decision ensures that the top 888 participants receive a more meaningful allocation, enhancing the overall fairness of the distribution.

- The average conversion ratios for various actions highlighted differences in how points were awarded. For example, depositing into the Stability Pool had a conversion ratio of 9,050, while minting veCLEO had a much higher ratio of 41,212.12.

Next Steps

→ Commence Public Blind Auction, set for ~12th August 2024

→ After successful sale expiry, liquidity will be seeded close to the auction final price (~15th)

→ AU Staking will commence the same time as liquidity becoming available (~16th)

→ After the time-weighted price and staking volatility has settled we will conduct the oAU distribution for Salt earners (~20th)

Are you ready for what is to come, Legionnaire?